Why Do Mortgage Rates Rise When Fed Cuts Rates: Explained

Powell Wants 7% Mortgage Rates. No Interest Rate Cuts In 2023.

Keywords searched by users: Why do mortgage rates go up when Fed cuts rates mortgage rates vs fed funds rate chart, Us mortgage rates, How banks set mortgage rates, federal reserve mortgage interest rates today, Fed increase rate, Interest rate affect mortgage, Fed increase interest rate effect on stock market, fed meeting mortgage rates

Will My Mortgage Go Up If The Fed Raises Interest Rates?

Will an increase in interest rates by the Federal Reserve impact my mortgage payments? This is a common question among homeowners, and the answer depends on the type of mortgage you have. If you have a Home Equity Line of Credit (HELOC) or an Adjustable Rate Mortgage (ARM), your mortgage payment may indeed go up in response to higher interest rates set by the Fed. However, if you have a fixed-rate mortgage, your monthly payment will remain unchanged regardless of any interest rate fluctuations. It’s important to understand the type of mortgage you hold, as this will determine whether or not your mortgage payment is affected by changes in interest rates.

Why Does The Fed Rate Affect Mortgage Rates?

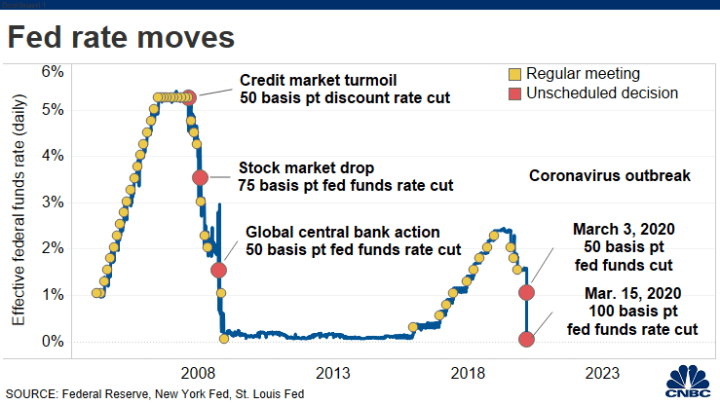

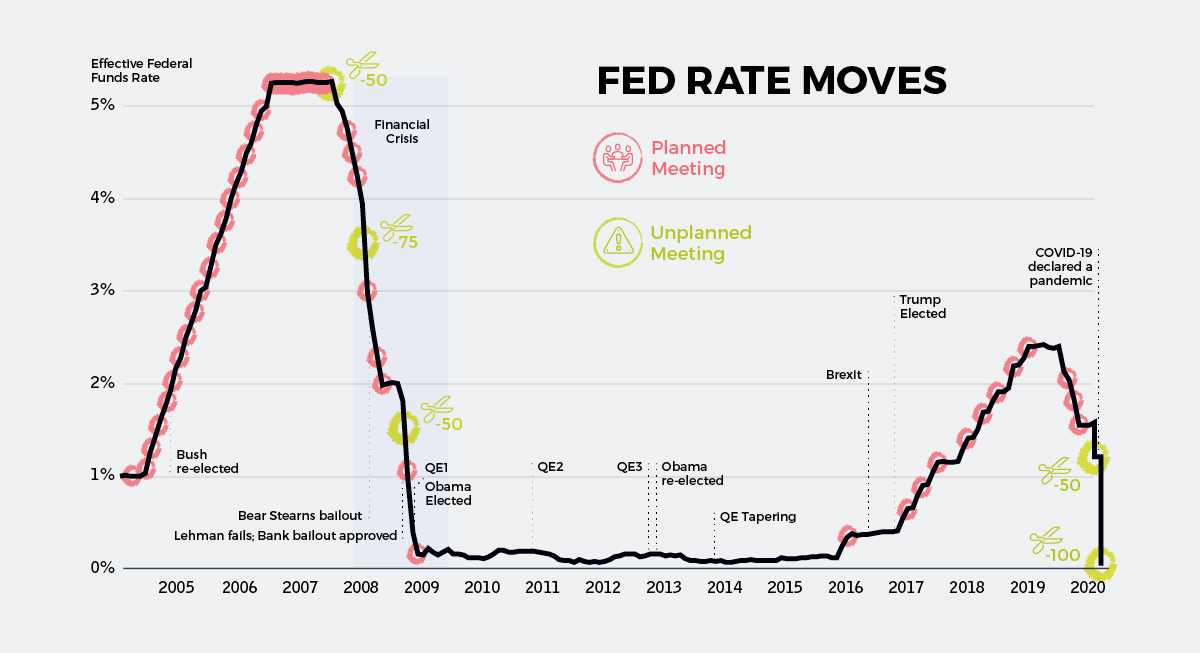

Have you ever wondered why changes in the Federal Reserve’s interest rate, known as the federal funds rate, have an impact on mortgage rates? Well, here’s the scoop: When the Federal Reserve decides to increase the federal funds rate, it essentially makes it more costly for banks to borrow money from each other. Now, you might be wondering, “How does this affect me?” The answer lies in how these increased borrowing costs can trickle down to consumers. You see, when banks face higher borrowing expenses, they often raise the interest rates they charge on various financial products. This includes not only lines of credit and auto loans but also, to some extent, mortgage loans. So, if you’re planning to buy a home or refinance your existing mortgage, you’ll want to pay attention to the Federal Reserve’s rate decisions, as they can influence the interest rates you’ll encounter in the mortgage market. As of February 22, 2023, this dynamic was at play, with the Federal Reserve’s rate changes potentially affecting the rates you see on mortgages and other loans.

Share 14 Why do mortgage rates go up when Fed cuts rates

:max_bytes(150000):strip_icc()/gH8Ic-one-year-nbsp-of-rate-hikes-impact-on-the-s-amp-p-500-nbsp-1-90987846c62546afbabc571948c28c62.jpg)

Categories: Discover 28 Why Do Mortgage Rates Go Up When Fed Cuts Rates

See more here: moicaucachep.com

Learn more about the topic Why do mortgage rates go up when Fed cuts rates.

- How will a Federal Reserve rate hike affect mortgages?

- What the Fed Interest Rate Hikes Mean for Home Buyers, Owners …

- How does the Federal Reserve affect mortgage rates?

- The Relationship Between Mortgage Rates and the Fed Funds Rate – ADM

- How the Federal Reserve Affects Mortgage Rates

- How Interest Rate Cuts Affect Consumers

See more: https://moicaucachep.com/sports blog