Is There A Clear Advantage In Choosing Fifo, Lifo, Or Weighted Average Costing?

Fifo Vs. Lifo Vs. Weighted Average Cost

Keywords searched by users: Is there a benefit behind using either FIFO LIFO or the weighted average costing method Weighted average method là gì, Comparison between fifo and weighted average method, Weighted Average Cost method là gì, Weighted average vs fifo process costing, Weighted average cost, when prices are falling, valuing inventory using the lifo method rather than fifo gives, Which of the following statements about the first-in, first-out (FIFO assumption is true), FIFO method

What Are The Advantages Of Fifo And Weighted Average?

FIFO (First-In-First-Out) and weighted average are two widely used inventory valuation methods in accounting. FIFO is based on the principle that the oldest inventory items are sold first, while weighted average calculates the average cost of all inventory items.

The advantages of using the FIFO method are as follows:

-

Reflects Current Market Value: FIFO ensures that the cost of goods sold (COGS) closely mirrors the current market prices because it assumes that the oldest inventory items, usually purchased at lower prices, are the first to be sold. This is particularly advantageous when dealing with price fluctuations in volatile markets, as it helps in accurately valuing inventory and assessing profitability.

-

Matches Physical Flow: In most cases, FIFO aligns with the physical flow of inventory, making it a straightforward method

What Are The Benefits Of Fifo Vs Lifo?

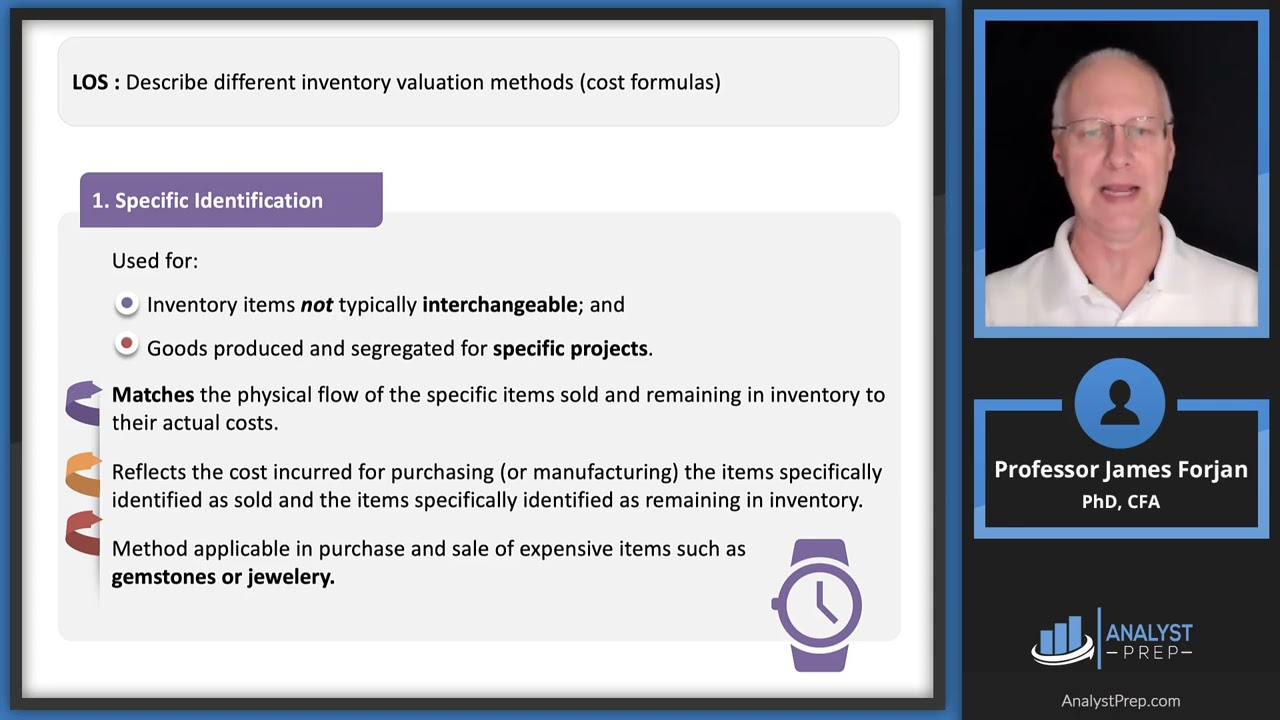

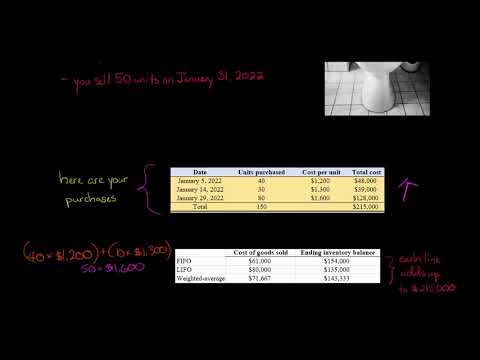

When it comes to managing inventory in accounting and investing, the choice between FIFO (First-In-First-Out) and LIFO (Last-In-First-Out) methods holds distinct advantages depending on the price trends of the products. FIFO is generally considered a superior approach when prices are on the rise. This is because it ensures that the oldest, lower-cost inventory is sold first, resulting in lower taxable income and higher reported profits. Conversely, LIFO accounting becomes a more advantageous strategy when prices are declining. In such cases, it allows for the sale of more recently acquired, higher-cost inventory first, which can help reduce taxable income and provide tax benefits during periods of falling prices. Ultimately, the decision between FIFO and LIFO hinges on the prevailing price dynamics and their impact on financial reporting and tax liabilities.

Which Is Better Fifo Or Weighted Average?

Many organizations often debate whether FIFO (First-In, First-Out) or weighted average is the superior inventory costing method. FIFO holds a prominent position as the preferred choice for many organizations due to its distinctive advantage of minimizing the risk of holding outdated inventory. Under the FIFO method, companies ensure that their inventory reflects the most current market prices as items purchased most recently are sold or used first. This approach not only aligns with financial reporting standards but also aids in maintaining accurate financial statements. The use of FIFO ensures that a company’s balance sheet and income statement reflect the true economic realities of their inventory, providing stakeholders with a clearer picture of the company’s financial health. As a result, FIFO is favored by organizations aiming to maintain transparency and uphold accounting accuracy.

In contrast, the weighted average method calculates the cost of goods sold and ending inventory by averaging the costs of all items in stock, irrespective of their purchase date. While this method provides a simple and straightforward approach, it may not always accurately represent the actual cost of inventory, especially when prices fluctuate significantly over time.

Ultimately, the choice between FIFO and weighted average depends on various factors, including a company’s specific inventory management needs, financial reporting requirements, and the nature of their products or services. By carefully considering these factors, organizations can make an informed decision on which inventory costing method best suits their operations.

Collect 35 Is there a benefit behind using either FIFO LIFO or the weighted average costing method

:max_bytes(150000):strip_icc()/fifo_sourcefile-a61d7a8879ed416ca3ffea6c8da8322f.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1016978230-7a03a0efc9da4831acfa65178f449465.jpg)

Categories: Summary 32 Is There A Benefit Behind Using Either Fifo Lifo Or The Weighted Average Costing Method

See more here: moicaucachep.com

FIFO tends to reflect current market prices better. LIFO better matches current costs with revenue and provides a hedge against inflation. Choosing among weighted average cost, FIFO, or LIFO can have a significant impact on a business’ balance sheet and income statement.This method assumes that the oldest inventory has the lowest cost, and the newest inventory has the highest cost. The advantages of using FIFO are that it reflects the current market value of the inventory, it matches the physical flow of inventory in most cases, and it minimizes the risk of inventory obsolescence.In terms of investing in accounting inventory, FIFO is usually a better method for inventory when prices are rising, and LIFO accounting is better when prices fall because more expensive products are sold first.

Learn more about the topic Is there a benefit behind using either FIFO LIFO or the weighted average costing method.

- Weighted Average vs. FIFO vs. LIFO: What’s the Difference?

- FIFO, LIFO, or Weighted Average: Which Inventory Costing Method to …

- FIFO vs LIFO: What Are They and When to Use Them — Katana

- Difference Between FIFO and Weighted Average

- FIFO, LIFO & Weighted Average | Cost Accounting – B Com PDF Download

- 5 Benefits of FIFO Warehouse Storage | Stein Service & Supply

See more: https://moicaucachep.com/sports